Text Messaging For Insurance Agents

Generate more insurance quotes and delight customers with fast and efficient communication. See how text messaging for insurance agents makes your agency better.

Text messaging offers many valuable benefits for your insurance agency when added to your communication channels. For your prospects, SMS gives them an easy channel to ask and answer quick questions in order to generate a quote for them.

For your agency, texting allows for faster and better communication with policy holders needing help and service. There is no doubt that text messaging can help grow your independent agency or multi-location insurance business.

Surveys show that over 74% of consumers want to text with a business. Let’s look at some of the top tips and ways that texting helps insurance agents.

Get More Leads and Quotes From Your Website

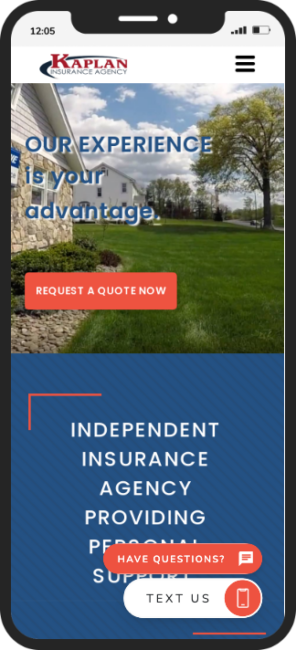

When you make a process easy, that process is used more and more. Offering prospects the ability to start a text conversation to get an auto or home insurance quote from your website is a major convenience.

Using our Leadbox, a web to text widget, your website visitors can start a conversation over text to get a quote or get questions answered. Marketing that you offer text messaging as a communication channel can help you stand out from your competition and acquire more leads.

SUPPORT YOUR INSURANCE QUOTE PROCESS

Once you get the conversation started with a prospect, it’s up to you or them on where it continues. While some prospects might be best getting on a phone call, others will prefer to keep texting. Having text messaging as an option will make your prospect happier as they have a choice to keep it a SMS conversation or move to another channel like email or phone to wrap up the details.

During the quote process, text is an easy channel to ask questions if something on the insurance quote is confusing. The bottom line is by giving your prospects and customers a choice, you are meeting and exceeding their expectations. You’re increasing the chance of landing a new customer.

PRO TIP: Use our Auto Replies to send new text messages a link to complete a quote form. Then use Zapier to automate those quote form results right back into your Leadferno thread with that customer so you can see all of their lead information.

Schedule More Appointments & Meetings

Texting will help you capture more appointments and set more meetings because texts are almost always read. Instead of being buried in an email inbox or leaving a voicemail they might not listen to, 90% of text messages are read within 3 minutes of being received.

For new prospects, a follow-up text from their initial call, email, form or text inquiry can help you book a time to meet with them.

Your current policy holders benefit too. SMS allows you to get more responses and set more appointments when reaching out to current customers for annual reviews or policy updates.

Share Photos For Quotes And Claims

A picture is worth a thousand words, so sending photos can be a huge time saver for all parties. For insurance this might include VINs, drivers licenses, property damage, policy details, and more. Our camera of choice is our smartphone, so being able to snap photos and text them over is a big benefit.

Ask For Reviews For Your Agency

Asking for online reviews to help market your agency online via text is very powerful. With your existing customers you can use texting to follow-up and make sure the customer is satisfied. If not, you have the ability to make things right before they might go an write an average or negative online review.

Your business might use a survey solution or reputation management software. The links to those surveys or review processes can be shared with your customer from the same number you have been talking with them all along. This makes for an easy way to capture the customer’s experience so you can improve or use their delight to acquire more reviews.

Using Business Text Messaging Software – Not Your Own Texting App

Leadferno gives you a business texting platform to power modern messaging communication. We’ve built business grade features for maximum efficiency. This allows you to transfer conversations to team members, used saved reply Shortcuts in just a tap, auto replies, set reminders and more.

Access your messaging conversations through our web app on your desktop or mobile app on your phone for an always available experience.

SECURITY OF YOUR BUSINESS DATA

Data security matters for any type of business. The most important aspect is the security that customer conversations, sales leads and contacts stay within your agency’s control and not on the employee’s phone. Leadferno also archives the history of your text conversations for security and compliance reviews.

By using text messaging software like Leadferno you are keeping control and securing your customer data. In the “bring your own device” to work world we operate in now, you need to secure your customer data, internal communication records and mange your team’s access.

Get Started Texting

We’ve shared some of the main factors for why you should be considering text messaging for your insurance agency. Sign-up for Leadferno’s 14-day free trial to get started or request a demo to learn more on how text messaging for insurance agents and agencies can grow your book of business.

Similar posts you may be interested in:

Categories:

Get our monthly update covering SMS, messaging, and Leadferno features.